What is the difference between primary and secondary stock markets

May 13, By Surbhi S Leave a Comment. Securities market can be defined as the market, whereby financial instruments, obligations, and claims are available for sale. It is classified into two interdependent segments, i. Primary Market and Secondary Market.

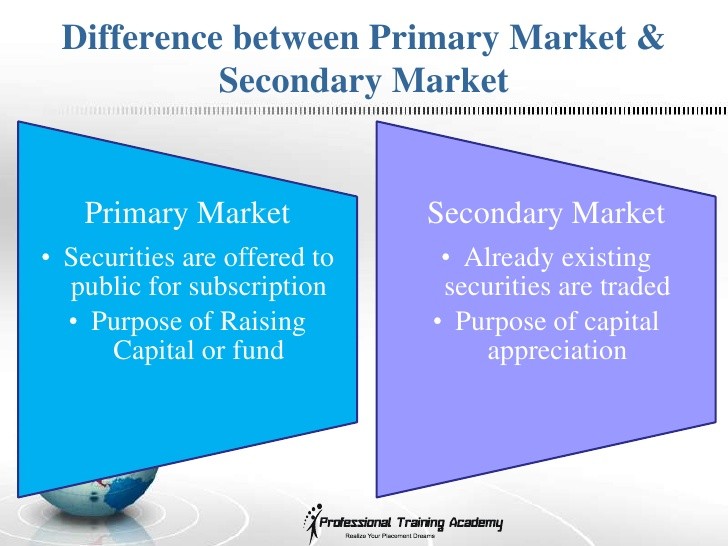

The former is a market where securities are offered for the first time for receiving public subscription while the latter is a place where pre-issued securities are dealt between the investors. While primary market offers avenues for selling new securities to the investors, the secondary market is the market dealing in securities that are already issued by the company.

Before investing your hard-earned money in financial assets like shares, debenture, commodities etc, one should know the difference between primary market and secondary market, to have better utilization of savings. Various types of an issue made by the corporation are a Public issue, Offer for Sale, Right Issue, Bonus Issue, Issue of IDR, etc.

The company who brings the IPO is known as the issuer, and the process is regarded as a public issue. The secondary market is a type of capital market where existing shares, debentures, bonds, options, commercial papers, treasury bills, etc. The secondary market can either be an auction market where trading of securities is done through the stock exchange or a dealer market, popularly known as Over The Counter where trading is done without using the platform of the stock exchange.

The top two stock exchanges of India are Bombay Stock Exchange and National Stock Exchange. The points given below are noteworthy, as far as the difference between primary market and secondary market is concerned:. In the primary market bulk purchasing of securities is not done while secondary market promotes bulk buying. Your email address will not be published. Business Finance Banking Education General Law Science IT.

What's the difference between primary and secondary capital markets? | Investopedia

Difference Between Primary Market and Secondary Market May 13, By Surbhi S Leave a Comment Securities market can be defined as the market, whereby financial instruments, obligations, and claims are available for sale.

Key Differences Between Primary Market and Secondary Market The points given below are noteworthy, as far as the difference between primary market and secondary market is concerned: The securities are formerly issued in a market known as Primary Market, which is then listed on a recognised stock exchange for trading, which is known as a secondary market.

Error (Forbidden)

The prices in the primary market are fixed while the prices vary in the secondary market depending upon the demand and supply of the securities traded. Primary market provides financing to new companies and also to old companies for their expansion and diversification. On the contrary, secondary market does not provide financing to companies, as they are not involved in the transaction.

Capital Markets, Difference between Primary and Secondary Markets, Financial Markets Part - 4, 12thAt the primary market, the investor can purchase shares directly from the company. Investment bankers do the selling of securities in case of Primary Market. Conversely, brokers act as intermediaries while trading is done in the secondary market.

In the primary market, security can be sold only once, whereas it can be done an infinite number of times in case of a secondary market. The amount received from the securities are income of the company, but same is the income of investors when it is the case of a secondary market.

The primary market is rooted in a particular place and has no geographical presence, as it has no organisational setup. Conversely, Secondary market is present physically, as stock exchnage, which is situated in a particular geographical area.

Related Differences Difference Between Money Market and Capital Market Difference Between Shareholders and Stakeholders Difference Between Stocks and Bonds Difference Between Shares and Debentures Difference Between Book Value and Market Value.

You Might Also Like: Difference Between Money Market and Capital Market Difference Between Cash Market and Future Market Difference Between Primary and Secondary Data Difference Between Demat and Trading Account Difference Between IPO and FPO Difference Between Primary and Secondary Research.

Leave a Reply Cancel reply Your email address will not be published.

What is the difference between a primary and secondary financial market? | Investopedia

Top 5 Differences Difference Between PERT and CPM Difference Between Developed Countries and Developing Countries Difference Between Management and Administration Difference Between Probability and Non-Probability Sampling Difference Between Pvt Ltd and Public Ltd Company. New Additions Difference Between Negotiation and Assignment Difference Between Competitive Advantage and Core Competence Difference Between Cost Sheet and Production Account Difference Between Cost Allocation and Cost Apportionment Difference Between Joint Product and By-Product Difference Between Pooling of Interest Method and Purchase Method Difference Between Traditional Budgeting and Zero-Based Budgeting Difference Between Internal and External Reconstruction Difference Between Open-Ended and Closed-Ended Mutual Funds Difference Between Decree and Order.

The place where formerly issued securities are traded is known as Secondary Market. It supplies funds to budding enterprises and also to existing companies for expansion and diversification.