888 best charts for binary options candlesticks

Best Binary Options Trading Strategies As a binary options trader, there is a number of different strategies and options you can use. I would recommend trying several different strategies and then sticking with the most profitable. After you have learned how to utilize just one of the strategies efficiently, you can little by little increase your knowledge of the other ones and build them into your repertoire.

By doing this, you will always have multiple options for getting as high a yield as you possibly can. Just what makes binary options very appealing is that aside from their straightforward reward-risk factors, investors determine when the trading starts and stops. Binary Options might go as short as just sixty seconds to finalize a trade.

In spite of the straightforward reward-risk variables, binary options trading requires people to have good strategies to trade effectively. There are numerous kinds of trading strategies which I will look into, to give you a sharper view of what the strategies are like. Get a binary option robot for free by clicking the button below! Technical Analysis Technical analysis entails the use of charts to be able to predict the price movements of assets.

It really is, in practice, the basis for every price prediction. If technical analysis entails the use of charts, fundamental analysis involves reading the business news or reports. Fundamental analysis is about studying the entire economic situation to speculate whether prices will shift or stay stable. Let us have a look at gold for example. Gold prices are declining now for numerous reasons. Fed have just stopped their quantitative easing, this action is predicted to raise interest rates for the U.

Previously, when Germany decided to take home some of its gold reserves from the U. Physical gold is utilized as a hedge against financial uncertainty, and so Germany is very well aware of that.

Things like these which you hear in the news are important to know to judge whether or not gold values will go up or down within a particular timeframe. Real-time monitoring of communication can help investors make wise judgment calls in binary options.

The Martingale method used in binary options calls for investors to increase two-fold the amount of their initial capital at each loss until a profit is attained. This kind of strategy possesses high risks compared to the gains since it requires investors to magnify their bets until their position becomes a winning one.

The theory of the Martingale strategy is usually to offset losing trades of earlier bets until an investor achieves their target. If a trader predicts the price patterns incorrectly many times consecutively, their loss will be extremely large. Beginners should absolutely stay away from this binary options approach. This type of analysis when applied to binary options, concentrates on the relationship between the prices of two assets in various markets, both of which on average move in the same direction.

The two assets have to be in markets that are interdependent to be used to conduct suitable correlation analysis. Correlation analysis is mainly plain and simple to use.

Price action trading is not going to take into account fundamental factors and is commonly used for short time periods. Simply put, price action takes into account how prices adjust. In a perfect situation, as we study the candlestick graph, we are going to notice an unusual change in the pattern. We will then wait a little for the price level to increase above this point support line as soon as the price drops below the support line again; we would consequently enter a trade heading on the same course the graph is heading once it drops below the support line.

Price action trading is used in lots of situations, and for you to use it well, it is important to familiarize yourself with candle stick Graphs. Learn more about using free online charts for binary options. An interesting fact about this trading approach is that a lot of financial institutions are basing their positions on the same pivot point and buying and selling large volumes, which has a direct impact on the price changes of the assets.

Retail-traders and individual investors must move into the trades at a similar time and direction to ride the same trends. Given this data, if at the given time-frame the cost of the pair of currencies gets to 1. Pivot point calculation normally is a technical evaluation formula that requires the application of a calculator.

Look at some of the links to cost-free web-based pivot point calculators.

Binary Option Pairs In binary option pairs trading, you have two different trading assets, and you need to know if either value will rise versus the other within the desired interval.

This is a particularly useful strategy in scenarios where you think that a specific event will raise the value of one trading commodity and decrease the value of another. Regardless of whether your guess is in part incorrect, and the value of both drops, it is possible to win if the asset that you initially thought would decline, in fact, falls even further.

This strategy is similar to stock investing. The termination time can vary from a couple of hours to several days and even months. This technique is my personal favorite. It is ideal for people who invest larger amounts of money and want to analyze the trading assets cautiously before making an investment. Sixty-second binary options are the exact opposite of long-term binary options.

These are a short term form of investment. With sixty-second binary options the risks are significant, but if you learn how to generate income with them, the sky is the limit in terms of how much money it is possible for you to earn. Sixty-second options are suitable for traders who are in a position to accept the fact that if you need to gain a lot of money, you have to be ready to lose a lot once in a while.

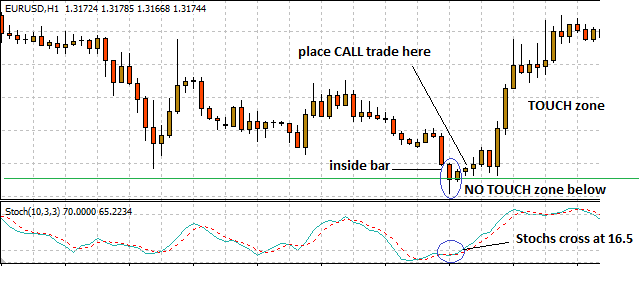

If you are trading with one touch binary options, you will be making a profit when the rate goes above or below the established target price. The amazing aspect tends to be that once you hit the target price value, the investment will not go wrong, even if the value of the asset shifts in a different direction strongly after that.

Ladder trading just as suggested by the name is a stepped approach. You have numerous levels, every one of which is paid a certain proportion of earnings. This form of investment is appropriate for those instances when the investor believes he understands which path the trading assets price will take, but is not sure of the amount of change there will be in the price and over what length of time.

The Pinocchio Strategy This is among the clearest and easiest techniques. When the price of the trading asset goes up, it is expected to fall next, and when the price of asset drops, it is projected to rise. The trader always invests in the complete opposite path of the market trend. The strategy operates with the assumption that markets often overreact to exclusive news, and for this reason, values will change dramatically for a short time, before stabilizing or rectifying themselves, in the end.

Candlestick charts can be a very handy for individuals who use Pinocchio strategy. The support line is the point at which the value will not dip below whereas the resistance line is the point at which the value will not rise above.

These often apply particularly to various commodities, such as the value of coffee or even sugar. Whenever values are entering a particular range within the framework, it is easy for the investor to benefit, as whenever the value is approaching one of the two levels it is most likely to go in the other direction soon.

Trend strategy is likewise a relatively easy strategy, as it is exquisite and functional, it is a technique that both beginners and experienced traders often use. You can use support as well as resistance lines for assistance to assess where the trend direction changes. The reversal strategy can be utilized with the trend trading approach. Although to implement this correctly some extent of technical analysis knowledge is required.

It is said that what goes up will have to come down! That is where this strategy comes into play. The characteristics of trends shown in the above paragraphs are that they will ultimately even-out, or even reverse.

Experienced and professional traders can predict with some precision, using graphs and charts, when a trend is likely to reverse — they will then continue earning money from the same asset if the trend they have been riding happens to do a U-turn. This technique is trend following, it uses two tools aside from price action, including a thirty day shifting average. Support and resistance lines, Fibonaccis, moving averages as well as other tools may be incorporated and will merely help serve to cut down false alerts and whipsaws.

The first thing to do is to establish a trend.

With regards to an uptrend, this is when prices drop to or below the moving average. In the case of a downtrend, this is when prices increase to or above the shifting average. The recommended expiry is three to five candles following the signal candle which means a day to a week depending on the charts you are using. The tool is most often utilized to help figure out a trend, trend strength and potential reversals. As a signal of reversal, it will be neutral. It provides divergences that can be an indication of reversals, but variation is a sketchy indicator to trade on regardless of the tool displaying it.

In most cases these divergences can go on for quite some time before any kind of significant reversal occurs. It produces results, consistently. If used in a trend following scenario the wild nature of the tool is excellent for determining movements near their point of origin.

This really is a significant improvement over most other patterns following strategies that only hope to capture the center portion of a movement, after the initial intense signal has long been fired. The inclusion of the moving average is an important step in this technique as well as one that helps seal its advantageous status. Place the overbought limit to eighty and the oversold limit to twenty. On the hourly graph, identify the first four candles of the present day. The first candle from the four candles is usually the one that starts at the Put simply, this is about four hours into a new market day which has started, on the hourly chart.

Hover the mouse on each of the four candles to establish which candle has reached the lowest and the top most point respectively. Go on drawing the two lines on your chart depending on the lowest price and the highest price touched by the four candles only, notice that candle wicks do continue to count.

You need to observe your charts or just set an alert so that when one candle touches one of your lines upper or lower you are ready to examine the charts. As soon as any of the horizontal lines is reached, you must look at the Stochastic Oscillator for verification.

If a candle has touched the top line, it implies that the Stochastic is going in the parallel direction up and should not be overbought. When a candle is touching the line below, Stochastic needs to be going down and should not be oversold.

Full text of "NEW"

In case all these rules apply, you may scroll down to the M15 time-frame and make sure that a fifteen minute candle closes above or below one of your lines, this is the signal to enter.

Notice that when the below line is crossed Stochastic is merely halfway down as well as moving in the same direction as the candles, down! The closing of this M15 candle is where you make an entry. The closing of this M15 candle is the entry point.

Another issue is the fact that there is no idea about expiries, or whether or not it performs as well in greater or lesser time frames! This strategy is also time bound, suppose the first four candles of the day end up being passed? What does one do then? Wait for the next day? I consider this technique to be remarkable for several reasons. Second, it uses only one indicator that is the Stochastic Oscillator, a powerful and reliable tool.

Next, it confirms breakouts plus keeps you in the direction of the trend by making use of more than just a single time frame. Fourth, you have an excellent chance of avoiding erroneous breakouts thereby helping you minimize your losses.

The revolt is a technique that attempts to pinpoint exhaustion within a trend. The blue line primarily represents the strength of buyers, while the red line represents the strength of sellers.

When purchasers are capable of making new highs, the blue line will go up, and the red line will drop. The blue line rising indicates there is a lot of buyer power and purchasers are in control, though at what point have the buyers gone too deep and spent their momentum?

It is in such instances that the sellers would revolt and take back the strength. Whenever the sellers are able to make new lows, the red line will go up, and the blue line will drop.

The Revolt is a technique that attempts to pinpoint exhaustion within a trend.

This technique is not time-frame reliant but bears a fairly short to medium expiry time zone relative to the timeframe being observed. Should you be looking at five minute periods of time, expect the move to be made in an hour or two.

Should you be looking at daily periods, the move may take a month or so. In the event that the buyers happen to be extremely powerful, then it is assumed that the sellers were essentially quite weak. Therefore, this will be represented by the redline falling below ten. When the blue line drops below ten, we consider this to be a signal of buyer weakness. The signal for DI below level ten will be established by the Stochastic Oscillator 5,3,3.

Such will be the spots on the market in which revolt is most likely to take place. This approach just does not work in some market environments. Particularly in trending markets. I would advise trading this system in ranging markets only, where you can define the way you see fit. The system is advantageous for the reason that it uses easy yet practical reasoning as the principle for its trades.

The simplicity allows traders to render quick decisions about their signals without getting a bunch of complex and confusing information. Just two indicators, that is it.

Forex FAQ | Frequently asked questions about gohabizaw.web.fc2.com

We are simply subscribing to the revolution in instances of surplus. This forex strategy includes administration risk characteristics which prevent you having to deal with a full loss of your traded capital along with the significant opportunity to profit.

Select your general direction: Choose your main asset then invest according to the overall direction you had previously decided upon. As soon as the value of our underlying financial asset advances according to our predicted guess, you make an opposing investment.

The accepted solution here is always to make an investment in the opposite direction. All going well, you could end up enjoying benefits in the two trades even if by the end of the trade the market price of the asset was between the striking value of your first and second investments. Conclusion Applying strategies to your investments is critical for your overall success in binary options trading. Just as trades fluctuate, applying the appropriate binary options strategy is also a dynamic skill all traders really should master.

Possessing a much better management of your binary option trading deals is essential to your understanding of the behavior of currency markets. The more you employ and observe these trading techniques, the higher the probability that any or all of your trades will be successful ones.

References and Further Reading A New Look at Currency Investing, CFA Age-dependent investing: Optimal funding and investment strategies in defined contribution pension plans when members are rational life cycle financial planners Target-driven investing: Evidence from Extended Families Individual investors and financial disclosure Corporate Investment and Stock Market Listing: The cross section of conditional mutual fund performance in European stock markets Stock Return Serial Dependence and Out-of-Sample Portfolio Performance Financial Advice and Stock Market Participation Contemporary Strategy Analysis Firm Characteristics and Stock Returns: The Role of Investment-Specific Shocks Improved AHP-group decision making for investment strategy selection Can Internet Search Queries Help to Predict Stock Market Volatility?

Martingale Limit Theory and Its Application Martingale Spaces and Inequalities Investing strategies for a star industry: Testing an Intraday Moving Average, Trading Strategy on Exchange Traded Funds Analysis of fractal trading strategy with the FTSE Bursa Malaysia KLCI Trading Strategy — More Trading, More Action, More To Come!

Duncan is a professional software engineer and investment manager specialized on trading software development. He has worked in investment banking for 12 years. These limitations of liability apply even if BinarySoftware. By using this website, you agree that the exclusions and limitations of liability set out in this website disclaimer are reasonable. If you do not think they are reasonable, you must not use this website.

Best Binary Options Trading Strategies Best Binary Options Trading Strategies As a binary options trader, there is a number of different strategies and options you can use. Techinical analysis is mostly numeric and done with all sort of charts.

Silver is a popular trading pair. Advantages of The Four Candles Technique I consider this technique to be remarkable for several reasons. Automatic Method for Stock Trading Strategy. Financial News Feed Trump: Senate could go further The Senate wants to make changes to Medicaid that would likely mean big cuts to the program, which covers more than 70 million low-income children, parents, elderly and the disabled.

House Speaker Paul Ryan is confident tax reform will happen this year. CNNMoney has traveled the country talking to factory workers. Over and over, they tell us they love their manufacturing jobs and don't want them to go away.

But they don't want their kids to do these jobs. Treasury department has added 38 people and entities to a list of sanctions targets, including two Russian officials. Ford to shift production of Focus from Michigan to China for export back to United States. Sex offenders can't be fully banned from social media sites, according to a Supreme Court ruling on Monday.

General Motors new ell-electric car got top marks in all of the Insurance Institute for Highway Safety's crash tests. Duncan Green Duncan is a professional software engineer and investment manager specialized on trading software development.

Cookie Policy Privacy Policy Contact Us.