Intrinsic value method for stock options

The intrinsic value is the actual value of a company or an asset based on an underlying perception of its true value including all aspects of the business, in terms of both tangible and intangible factors. This value may or may not be the same as the current market value. Additionally, intrinsic value is primarily used in options pricing to indicate the amount an option is in the money.

The discounted cash flow model is one commonly used valuation method used to determine a company's intrinsic value. The discounted cash flow model takes into account a company's free cash flow and weighted average cost of capital, which accounts for the time value of money.

Intrinsic Value

The intrinsic value for call options is the difference between the underlying stock's price and the strike price. Conversely, the intrinsic value intrinsic value method for stock options put options is the difference between the strike price and the underlying stock's price.

Intrinsic Value of Indian Stocks By Graham's Formula - gohabizaw.web.fc2.com

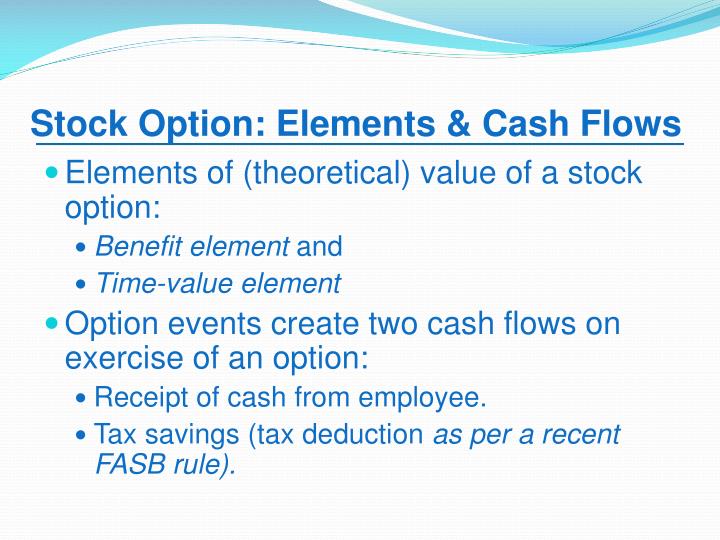

In the case of both puts and calls, intrinsic value method for stock options the respective difference value is negative, the intrinsic value is given as zero. Intrinsic value and extrinsic value combine to make up the total value of an option's price.

Forex market forecast today extrinsic value, or time value, takes into account the external factors that affect an option's price, such as implied volatility forex basics for beginners time value.

What Is The Intrinsic Value Of A Stock? - Video | Investopedia

Intrinsic value in options is the in-the-money portion of the option's premium. An option is usually never worth less than what an option holder can receive if the option is exercised. However, the option still has value, which only comes from the extrinsic value, which is worth 50 cents.

Dictionary Term Of The Day. A measure of what it costs an investment company to operate a mutual fund.

No Longer an Option

Latest Videos PeerStreet Offers New Way to Bet on Housing New to Buying Bitcoin? This Mistake Could Cost You Guides Stock Basics Economics Basics Options Basics Exam Prep Series 7 Exam CFA Level 1 Series 65 Exam.

Sophisticated content for financial advisors around investment strategies, industry trends, and advisor education. Extrinsic Value Time Value At The Money Large-Value Stock Option Premium Out Of The Money - OTM Valuation In The Money Margin Of Safety.

Content Library Articles Terms Videos Guides Slideshows FAQs Calculators Chart Advisor Stock Analysis Stock Simulator FXtrader Exam Prep Quizzer Net Worth Calculator. Work With Investopedia About Us Advertise With Us Write For Us Contact Us Careers. Get Free Newsletters Newsletters.

All Rights Reserved Terms Of Use Privacy Policy.