Stocks to own in rising interest rate environment

You are using an outdated browser.

Please upgrade your browser to improve your experience. Donald Trump's election as president has fueled a powerful stock-market rally rooted in expectations of faster economic growth in And with faster growth is likely to come higher interest rates. Long-term bond yields have already surged, and the Federal Reserve is likely to raise its benchmark short-term interest rate by 0.

That would be the first hike in 12 months. Many economists believe the Fed will boost rates twice more in And although rising rates are bad news for some businesses, they're a boon for others—particularly banks: When the Fed raises its rate, nearly all banks immediately raise their prime lending rate, the rate now 3.

But they're far slower to lift what they pay on deposits, so they earn a wider "spread" between the rates at which they lend and the rates they pay depositors. Banks also could gain from Trump's promise to ease financial regulation. We went hunting for banks and other companies that could benefit from rising rates and chose eight standouts. Stocks are listed alphabetically. Prices and related figures are as of December 6. Price-earnings ratios are based on estimated earnings over the next four quarters.

By Tom Petruno , Contributing Writer January BofA has spent the past seven years rebuilding from its near-death experience during the financial crisis, when it was saved by a government capital injection since repaid. Why rising interest rates will help: The Fed's expected 0. To put that sum in perspective, it would have lifted BofA's total net interest income by And if tax cuts and deregulation stoke the U. All banks should benefit from higher rates. The stock has rallied this fall. Bank of New York Mellon, which he launched in , remains a huge player in finance.

Those services include securities custody, record-keeping and clearing of trades. Like many banks, Bank of New York Mellon has been hurt as record-low interest rates since have limited its ability to make money on loans and fixed-income investments. So rising rates will boost that part of its business.

Goldman Sachs Stock Picks for Rising Interest Rates - TheStreet

CFRA Research figures that Bank of New York Mellon bought about 90 related businesses over the past 10 years including rival Mellon Financial in The focus on cost-cutting is now paying off: That helped boost net income by 7. With the stock priced at 14 times estimated year-ahead earnings, investors seem wary about the company's growth outlook. But fans say Bank of New York Mellon's long-term appeal lies in its deep client relationships, which Morningstar notes tend to be "sticky"—meaning clients mostly stay put.

These Sectors Benefit From Rising Interest Rates (BAC, GS) | Investopedia

If the money-management industry continues to grow worldwide, that should mean rising demand for Bank of New York Mellon's services. But investors should note that the company faces a number of risks that are more significant than for other big banks—including the downward pressure on investment-management fees stemming from the dramatic shift in the U.

Warren Buffett's company is perhaps America's most diversified conglomerate. Berkshire also controls a mammoth stock portfolio, including big stakes in Coca-Cola KO , International Business Machines IBM , Kraft Heinz KHC and Wells Fargo WFC. Berkshire's insurance operations, including Geico, stand to earn higher returns on their "float": That's one element of the huge amount of cash Buffett likes to keep on hand. Besides Wells Fargo, Berkshire owns chunks of American Express AXP , Bank of America, Goldman Sachs GS and U.

Buffett has long measured Berkshire's success by growth of shareholders' equity, or book value assets minus liabilities.

At the current share price, buyers are paying about 1. Buffett has said he considered Berkshire to be undervalued at 1. So the stock is at a premium to that "bargain" level—but not an outsized premium, given Berkshire's promising long-term growth outlook. But Capital One also has become a major provider of auto and business loans as it has doubled in size since Higher market rates should give Capital One more flexibility in raising rates on its credit cards and other loans.

Meanwhile, earnings have been depressed in in part because, as the bank lent more, it also set aside more money for possible loan losses. Actual loan charge-offs also have risen this year. But Capital One terms that "growth math": The bank allows early on for a weeding-out of bad borrowers, then reaps the benefits of the remaining good borrowers for years afterward. Investor concerns about Capital One's lending risk have depressed the stock relative to earnings, with the shares selling for 11 times estimated year-ahead profits.

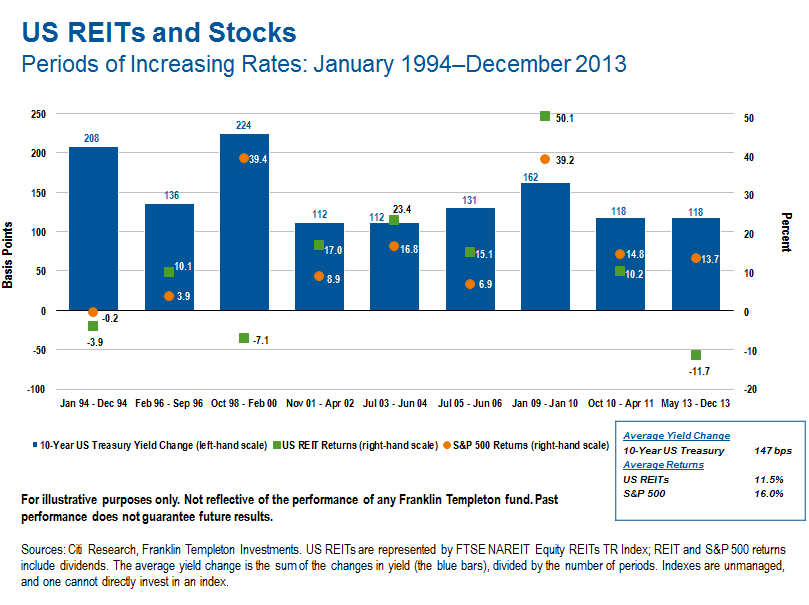

3 REITs for a Rising-Interest-Rate Environment -- The Motley Fool

Colin Plunkett, an analyst at Morningstar, believes Capital One "does not receive the respect it deserves. Erik Oja, an analyst at CFRA Research, says small businesses could benefit from Trump administration policies, and that could be a plus for Capital One because many small-business owners use credit cards to finance expansion.

Since Schwab has been synonymous with the rise of discount brokerage and low-cost investing in general, a boon for individual investors. The firm also has become a key provider of services to independent financial advisers. Trading commissions were once Schwab's bread and butter, but they have faded in importance.

That becomes an even better business as interest rates rise.

On the trading side, Schwab stands to benefit if rising rates cause more investors and advisers to adjust their portfolios—by, for example, selling bonds and buying stocks. At 26 times estimated earnings, the stock isn't cheap. Morningstar estimates that Schwab's operating income should nearly double over the next five years, as an aging population demands more financial help. Given Schwab's "massive scale," Morningstar says, it is "one of the only companies that can make online advisory for the masses profitable.

Goldman Sachs is both praised and vilified for its role as perhaps Wall Street's savviest player. It is a leader in providing financial advice to corporations such as on merger deals , underwriting of stocks and bonds, asset management, trading, and lending. But it's a much smaller enterprise than before the financial crisis: Like all lenders, Goldman should get a boost if the Federal Reserve pushes short-term rates up further and long-term rates follow. Looking to cash in, Goldman in October launched Marcus, a new online consumer lending business.

Higher interest earnings would complement the rising income Goldman earns from its growing asset- management business. But a sustained upturn in interest rates would benefit Goldman in other ways as well. Analyst David Konrad at brokerage Macquarie Capital says that higher rates stemming from a faster-growing U. Overall, the breadth of Goldman's expertise means it has "more earnings levers [to pull] than peers," Konrad says.

Paychex provides a host of services to , small and midsize businesses nationwide. The firm, founded in , is best known for handling companies' payrolls.

It also provides human-resources services, such as administration of employee benefits. Paychex charges fees for its services, but it also makes money another way: So higher rates should be a "significant tailwind" over time for Paychex's bottom line, Morningstar says. Paychex stands to benefit if President-elect Trump's promise to deregulate the economy and cut taxes results in a surge in small-business start-ups and expansions.

Paychex's steady growth has helped the stock double since —and has also kept it pricey, at 26 times estimated year-ahead earnings.

Charles Carlson, head of money manager Horizon Investment Services, in Hammond, Ind. It operates in 25 western and midwestern states. Bancorp has long been a classic "steady as she goes" bank. Thanks to conservative lending practices, the company managed to avoid the disasters that befell many of its peers during the financial crisis. Still, the long period of rock-bottom interest rates sapped U. It was able to compensate somewhat with strong fee income from other businesses, such as investment management and retailer payment-processing.

Even so, annual earnings have been little changed since Rising interest rates would help fix that. CFRA Research expects U. Bancorp's net interest income to jump 7. With the stock priced at 15 times estimated earnings, it may be fairly valued in the short run. But any pullback could be a great opportunity for investors looking for a strong domestic bank that is committed to rewarding shareholders by raising dividends and buying back shares.

Buyers would be in good company: View as One Page. Toggle navigation Menu Subscribers Log In. Sections Close Menu Wealth Creation Investing Retirement Taxes Your Money Your Business Magazine Contents.

See All Marketplace Special Reports Tools Slide Shows Quizzes Videos Columns Basics of Personal Finance Economic Outlooks. Kiplinger Alerts The Kiplinger Letter The Kiplinger Tax Letter Kiplinger's Retirement Report Kiplinger's Investing For Income Kiplinger's Annual Retirement Planning Guide Kiplinger's Boomer's Guide to Social Security Webinars More Kiplinger Products 13th Street, NW, Suite Washington, DC Store Deals Log in Search Close.

Toggle navigation Menu Subscribers.

Store Deals Log in. Find Hot Deals in Kiplinger's New Marketplace. SLIDE SHOW Best Index Funds for Every Investor.

QUIZ Will It Sink Your Credit Score? SLIDE SHOW Best Credit Unions Anyone Can Join, Slide Show 1 of 9. Slide Show 2 of 9. Slide Show 3 of 9. Slide Show 4 of 9. Slide Show 5 of 9. Slide Show 6 of 9. Slide Show 7 of 9. Slide Show 8 of 9. Slide Show Start Over Next Slide Show 27 Best Stocks to Own in Check Out Kiplinger's Latest Online Broker Rankings googletag.

About Us Employment Opportunities Privacy Policy Terms of Service Millennium Copyright Act Site Map RSS.