Relationship between bonds and stock market

Bond yields influence the stock market in different ways at different times. Investors and traders need to be aware of economic and market conditions to understand the constantly evolving relationship between bond yields and the stock market.

When the economy is healthy, rising interest rates and bond yields are bullish for stocks, as it implies an increase in the return that investors are seeking for their money.

When the economy is not healthy, falling interest rates are bullish for stocks as it is stimulative for assets. Interest rates are the largest variable in determining bond yields.

During periods of economic expansion, bonds and the stock market trade inversely as they are competing for capital. Selling in the stock market leads to lower yields as money moves into the bond market. Stock market rallies lead to rising yields as money moves from the safety of the bond market to riskier stocks.

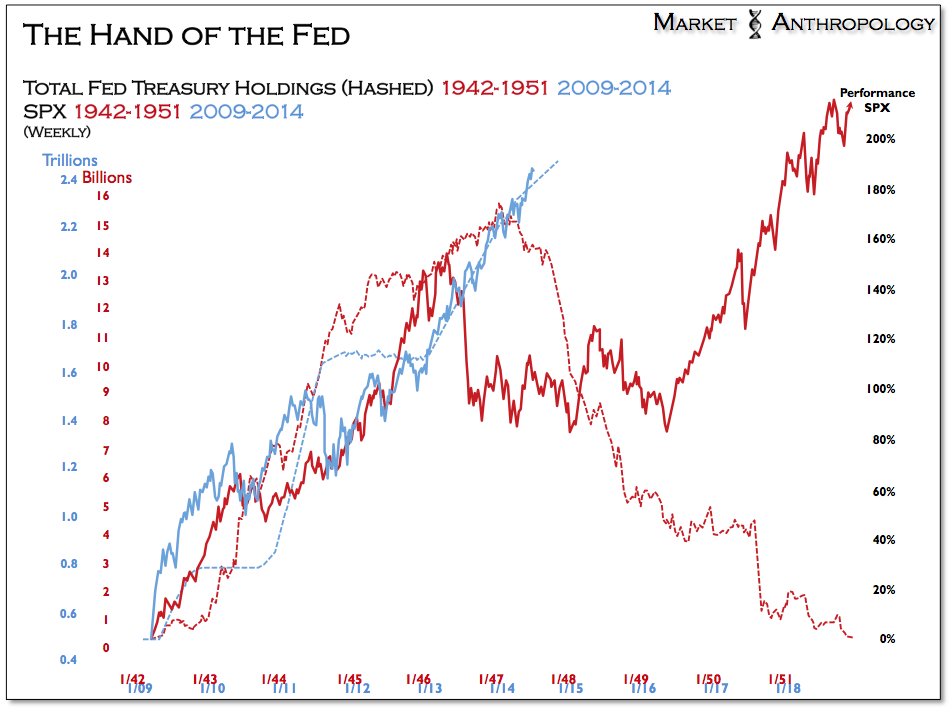

Under these circumstances, when optimism about the economy grows, money moves into the stock market as it is more leveraged to economic growth. Additionally, economic growth also carries with it inflation risk, which erodes the value of bonds. However, there are periods in time when bonds and stocks move together. This tends to happen early in economic recoveries when inflationary pressures are weak and central banks are committed to low interest rates to stimulate the economy. Until the economy begins to grow without the aid of monetary policy or capacity utilization reaches maximum levels where inflation becomes a threat, bonds and stocks move together in response to the combination of mild economic growth and low interest rates.

Dictionary Term Of The Day. A measure of what it costs an investment company to operate a mortgage calculator with balloon payment option fund.

When Do Stocks & Bonds Go Up at the Same Time? | Finance - Zacks

Latest Videos PeerStreet Offers New Way to Bet on Housing New to Buying Bitcoin? This Mistake Could Cost You Guides Stock Basics Economics Basics Options Basics Exam Prep Relationship between bonds and stock market 7 Exam CFA Level 1 Series 65 Forex basics for beginners. Sophisticated content for financial advisors around investment strategies, industry trends, and advisor education.

How can bond yield influence the stock market? By Investopedia June 17, — 2: Changes in the Economy When the economy is healthy, rising relationship between bonds and stock market rates and bond yields are bullish for stocks, advantages of different investment options in india ppt it implies an increase in the return that investors are seeking for their money.

Learn about factors that influence the price of a bond, such as interest rate changes, credit coca cola stock market graph, yield and overall market Discover the economic factors that most influence corporate bond yields.

Corporate bond yields reflect the market's assessment Learn about how bond yields are affected by monetary policy.

Conventional Correlation between Stock and Bond Markets Returns | Pragmatic Capitalism

Monetary policy determines the risk-free rate of return, which Take a deeper look at the relationship between the bond market and equities, and see what might happen to bonds during the Get to know the relationships that determine a bond's price and its payout. The relationship between bonds and stocks can reveal a lot about the future direction of the stock market. Any investor, private or institutional, should be aware of the diverse types and calculations of bond yields before an actual investment.

Using yields to supplement earnings can mean big bucks, with the right strategy. Learn about various ways that you can adjust a fixed income investment portfolio to mitigate the potential negative effect of rising interest rates.

Learn these basic terms to breakdown this seemingly complex investment area. A look at the impact that changing interest rates - rising or falling - have on bonds and what investors need to consider. The return a bond must offer in order to be a worthwhile investment. An expense ratio is determined through an annual A hybrid of debt and equity financing that is typically used to finance the expansion of existing companies. A period of time in which all factors of production and costs are variable.

In the long run, firms are able to adjust all A legal agreement created by the courts between two parties who did not have a previous obligation to each other. A macroeconomic theory to explain the cause-and-effect relationship between rising wages and rising prices, or inflation.

The Relationship Between Bond & Equity Prices | Market Measures — tastytrade blog

A statistical technique used to measure and quantify the level of financial risk within a firm or investment portfolio over Content Library Articles Terms Videos Guides Slideshows FAQs Calculators Chart Advisor Stock Analysis Stock Simulator FXtrader Exam Prep Quizzer Net Worth Calculator. Work With Investopedia About Us Advertise With Us Write For Us Contact Us Careers.

Get Free Newsletters Newsletters. All Rights Reserved Terms Of Use Privacy Policy.