When preparing a statement of cash flows indirect method an increase in ending inventory

Preparing the statement of cash flows using the direct method would be a simple task if all companies maintained extremely detailed cash account records that could be easily summarized like this cash account:.

Choose The Correct Answer Which Of The Followi | gohabizaw.web.fc2.com

Most companies record an extremely large number of transactions in their cash account and do not record enough detail for the information to be summarized. Therefore, the statement of cash flows is prepared by analyzing all accounts except the cash accounts. Remember that in accounting, all transactions affect at least two accounts.

If cash increases or decreases, at least one other account also changes. If cash increases, that increase may also decrease another asset account, such as accounts receivable payment from customer on account or equipment sale of equipmentor increase the sales account cash sales. Similarly, if cash decreases, there may be an increase in another asset account, such as inventory purchase of inventory or equipment purchase of equipmenta decrease in a liability account, such as accounts payable payment to creditor or notes payable payment on loanor an increase in an expense account payment to vendor.

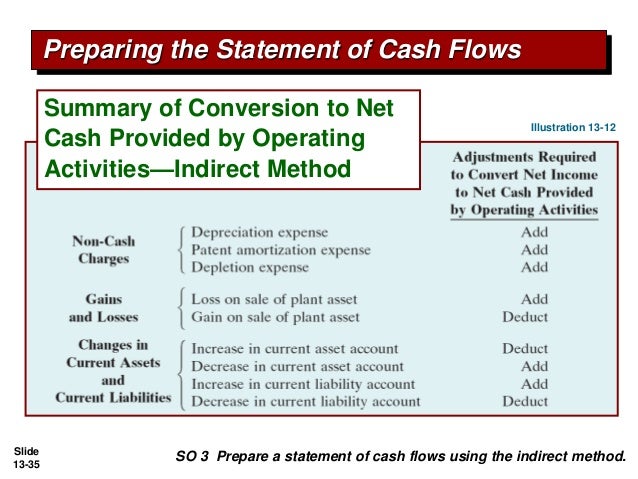

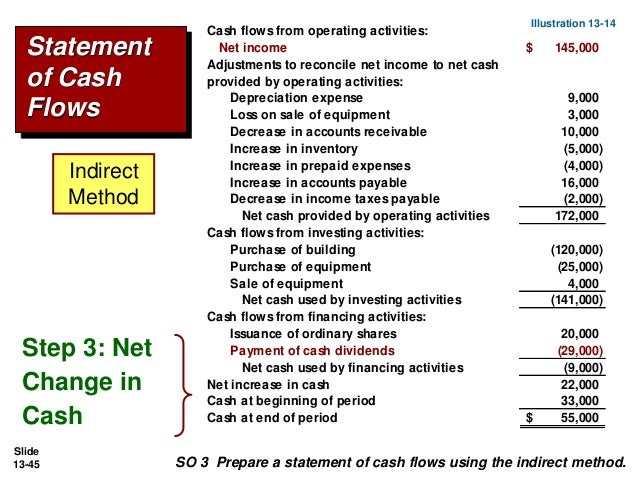

Statement of Cash Flows (Indirect Method)Table summarizes many cash activities and the related financial statement accounts used to analyze each listed activity. To prepare the operating activities section, certain accounts found in the current assets and current liabilities section of the balance sheet are used to help identify the cash flows received and incurred in generating net income.

Cash collections from customers This consists of sales made for cash cash sales and cash collected from credit customers. The activity in the accounts receivable and sales accounts is used to determine the cash collections from customers. If the accounts receivable balance had increased, the cash collected from customers would be determined by subtracting the increase in the accounts receivable balance from the sales balance because an increase in accounts receivable means your customers owe you the cash for their purchases your sales.

Cash payments to suppliers. This represents the amount paid by the company for merchandise it plans to sell to its customers. An increase in inventory means a company purchased more than it sold. Because the amount paid for merchandise includes what was sold as well as what still remains on hand in inventory to be sold, the change in inventory effects the cash payments to suppliers.

To determine the amount that has actually been paid for the merchandise purchased, a second step is needed. The decrease in accounts payable is added to the amount of the purchases because a decrease in the accounts payable balance means more cash was paid out than merchandise was purchased on credit. If the inventory account balance had decreased, the decrease would be subtracted from the cost of goods sold to calculate the cost of goods purchased because the decrease indicates less merchandise was purchased than was sold during the period.

If the accounts payable balance had increased, the amount of the increase would have been subtracted from the cost die forex trading methodology manual by gene ballard goods purchased to determine cash payments to suppliers because the accounts payable increase means you have a loan from your suppliers and have not yet paid cash for your purchases.

Cash payments for operating expenses. This includes wages and other operating costs. To calculate the cash payments for operating expenses, two steps are required. Second, the balance is adjusted for changes in the balances of related when preparing a statement of cash flows indirect method an increase in ending inventory sheet accounts. For Brothers' Quintet, Inc. As with the prior calculations, the calculation changes with the forexpros grafico euro dollaro of the change in the balances of the related balance sheet accounts.

The operating expenses excluding depreciation expense would be decreased by a decrease in the prepaid expenses account's balance, increased by a decrease in the balance of the wages payable account, and decreased by an increase in the balance of the accrued expenses account. Cash payments for income taxes.

Preparing the Statement: Direct Method

This represents amounts paid by the company for income taxes. The amount is calculated by taking income tax expense and increasing it by the amount of any decrease in the balance of the income taxes payable account or decreasing it by the amount of any increase in the balance of the income taxes payable account. In this case, there are no accrued taxes so the income tax expense is the same as cash paid for income taxes.

Cash paid for interest. This represents amounts paid by the company for interest. The amount is calculated by taking interest expense and increasing it by the amount of any decrease in the balance of the interest payable account or decreasing it by the amount of an increase in the balance of the interest payable account.

In this case, there is no balance in the accrued interest account at the end of the period so the cash paid for interest is the same as the interest expense. Stock price during buyout of equipment This includes the amount of cash paid for equipment.

If a note had been taken in exchange for a portion of or all of the purchase price of the equipment, only the cash actually paid would be reported as a payment on the statement of cash flows.

The portion of the purchase price represented by the note would be separately disclosed if it were a material amount.

The cash received from the sale is reported here. The proceeds are not adjusted for any gain or loss that may also have been recorded on the sale because only the proceeds represent cash, the gain or loss represents the difference between the book value of the assets and the value received.

For the Brothers' Quintet, Inc. Proceeds for bank loan. Borrowings are not shown net of repayments. Each is treated as a separate activity to be reported on the statement of cash flows. Proceeds from sale of stock. This represents the cash received from the issuance of new shares to investors. Cash payments of dividends. This is the amount of dividends paid during the year. As the statement of cash flows includes only cash activity, the declaration of a dividend does not result in any reporting on the statement, it is only when the dividends are paid that they are included in the statement cash flows.

In analyzing the retained earnings account, the other activity is the net income. The cash activities related to generating net income are included in the operating activities section of the statement of cash flows, and therefore, are not included in the financing activities section.

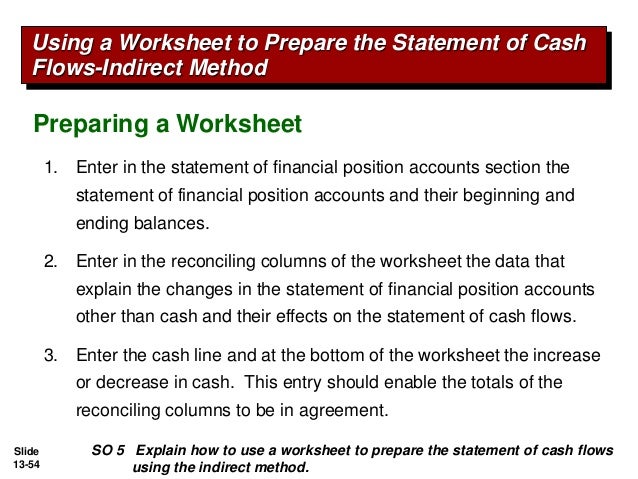

Reconciliation of net income to cash provided by used by operating activities.

If the direct method of preparing the statement of cash flows is used, the Financial Accounting Standards Board requires companies to disclose the reconciliation of net income to the net cash provided by used by operating activities that would have been reported if the indirect method had been used to prepare the statement. Removing book from your Reading List will also remove any bookmarked pages associated with this title.

Are you sure you want to remove bookConfirmation and any corresponding bookmarks? CliffsNotes study guides are written by real teachers and professors, so no matter what you're studying, CliffsNotes can ease your homework headaches and help you score high on exams.

The Indirect Method for Cash Flow Statements for Inventory and Balances | Your Business

My Preferences My Reading List Sign Out. Literature Notes Test Prep Study Guides Student Life. Home Study Guides Accounting Principles II Preparing the Statement: Stockholders' Equity Income Statement Characteristics of a Corporation Stock Terminology Investments Accounting for Debt Securities Accounting for Equity Securities Balance Sheet: Classification, Valuation Introduction to Investments Statement of Cash Flows Preparing the Statement Preparing the Statement: Direct Method Preparing the Statement: Stockholders' Equity Income Statement Characteristics of a Corporation Stock Terminology Accounting for Debt Securities Accounting for Equity Securities Balance Sheet: Classification, Valuation Introduction to Investments Preparing the Statement Preparing the Statement: Adam Bede has been added to your Reading List!

About CliffsNotes Advertise with Us Contact Us Follow us: Literature Notes Test Prep Study Guides Student Life Sign In Sign Up.