Stock market macd chart

Learning to trade in the direction of short-term momentum can be a difficult task at the best of times, but it is exponentially more difficult when one is unaware of the appropriate tools that can help. This article will focus on the most popular indicator used in technical analysis , the moving average convergence divergence MACD. Gerald Appel developed this indicator in the s, and although its name sounds very complicated, it's really quite simple to use.

Read on to learn how you can start looking for ways to incorporate this powerful tool into your trading strategy.

Background Knowledge The popularity of the MACD is largely due to its ability to help quickly spot increasing short-term momentum. However, before we jump into the inner workings of the MACD, it is important to completely understand the relationship between a short-term and long-term moving average.

As you can see from the chart below, many traders will watch for a short-term moving average blue line to cross above a longer-term moving average red line and use this to signal increasing upward momentum.

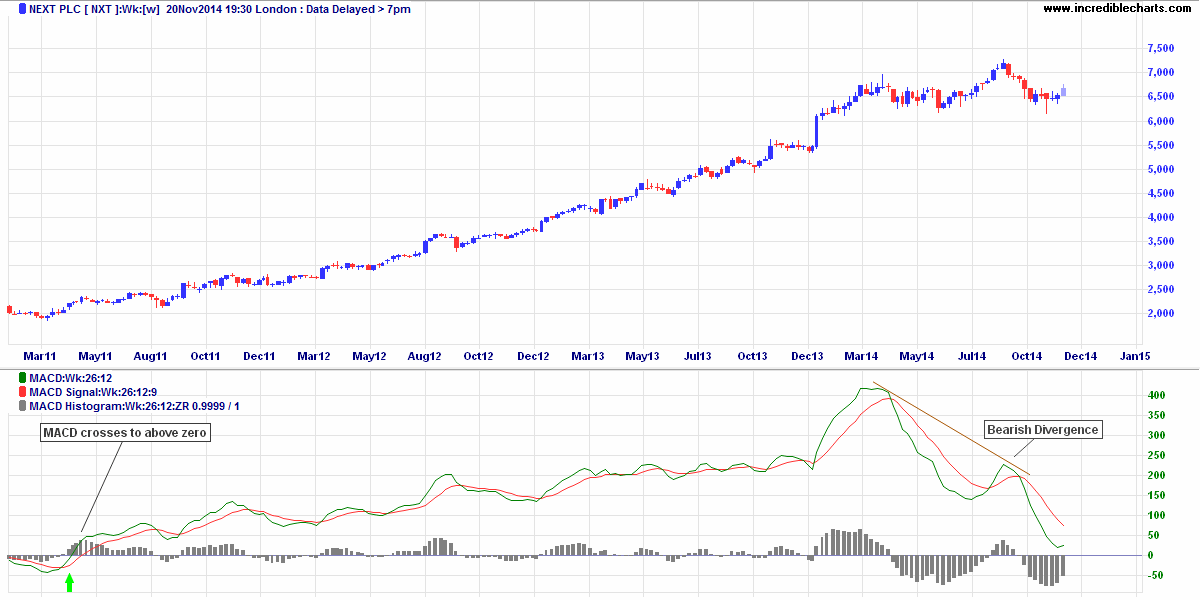

This bullish crossover suggests that the price has recently been rising at a faster rate than it has in the past, so it is a common technical buy sign. Conversely, a short-term moving average crossing below a longer-term average is used to illustrate that the asset's price has been moving downward at a faster rate, and that it may be a good time to sell. The Indicator Notice how the moving averages diverge away from each other in Figure 1 as the strength of the momentum increases.

The MACD was designed to profit from this divergence by analyzing the difference between the two exponential moving averages.

Specifically, the value for the long-term moving average is subtracted from the short-term average, and the result is plotted onto a chart. The periods used to calculate the MACD can be easily customized to fit any strategy, but traders will commonly rely on the default settings of and day periods. A positive MACD value, created when the short-term average is above the longer-term average, is used to signal increasing upward momentum.

This value can also be used to suggest that traders may want to refrain from taking short positions until a signal suggests it is appropriate. On the other hand, falling negative MACD values suggest that the downtrend is getting stronger, and that it may not be the best time to buy. Transaction Signals It has become standard to plot a separate moving average alongside the MACD, which is used to create a clear signal of shifting momentum.

A signal line , also known as the trigger line , is created by taking a nine-period moving average of the MACD. This is found plotted alongside the indicator on the chart. As you can see in Figure 2, transaction signals are generated when the MACD line the solid line crosses through the signal line nine-period exponential moving average EMA - dotted blue line.

The basic bullish signal buy sign occurs when the MACD line the solid line crosses above the signal line the dotted line , and the basic bearish signal sell sign is generated when the MACD crosses below the signal line. Traders who attempt to profit from bullish MACD crosses that occur when the indicator is below zero should be aware that they are attempting to profit from a change in momentum direction, while the moving averages are still suggesting that the security could experience a short-term sell-off.

This bullish crossover can often correctly predict the reversal in the trend as shown in Figure 2, but it is often considered riskier than if the MACD were above zero.

Another common signal that many traders watch for occurs when the indicator travels in the opposite direction of the asset, known as divergence. This concept takes further study and is often used by experienced traders. The Centerline As mentioned earlier, the MACD indicator is calculated by taking the difference between a short-term moving average day EMA and a longer-term moving average day EMA.

Given this construction, the value of the MACD indicator must be equal to zero each time the two moving averages cross over each other. As you can see in Figure 3, a cross through the zero line is a very simple method that can be used to identify the direction of the trend and the key points when momentum is building.

Advantages In the previous examples, the various signals generated by this indicator are easily interpreted and can be quickly incorporated into any short-term trading strategy.

At the most basic level, the MACD indicator is a very useful tool that can help traders ensure that short-term direction is working in their favor. Drawbacks The biggest disadvantage of using this indicator to generate transaction signals is that a trader can get whipsawed in and out of a position several times before being able to capture a strong change in momentum.

As you can see in the chart, the lagging aspect of this indicator can generate several transaction signals during a prolonged move, and this may cause the trader to realize several unimpressive gains or even small losses during the rally. Traders should be aware that the whipsaw effect can be severe in both trending and range-bound markets, because relatively small movements can cause the indicator to change directions quickly.

The large number of false signals can result in a trader taking many losses. When commissions are factored into the equation, this strategy can become very expensive. Another MACD drawback is its inability to make comparisons between different securities. Because the MACD is the dollar value between the two moving averages, the reading for differently priced stocks provides little insight when comparing a number of assets to each other. In an attempt to fix this problem, many technical analysts will use the percentage price oscillator , which is calculated in a similar fashion as the MACD , but analyzes the percentage difference between the moving averages rather than the dollar amount.

Conclusion The MACD indicator is the most popular tool in technical analysis, because it gives traders the ability to quickly and easily identify the short-term trend direction.

The clear transaction signals help minimize the subjectivity involved in trading, and the crosses over the signal line make it easy for traders to ensure that they are trading in the direction of momentum.

MACD (Moving Average Convergence/Divergence Oscillator) [ChartSchool]

Very few indicators in technical analysis have proved to be more reliable than the MACD, and this relatively simple indicator can quickly be incorporated into any short-term trading strategy. Dictionary Term Of The Day. A measure of what it costs an investment company to operate a mutual fund.

Latest Videos PeerStreet Offers New Way to Bet on Housing New to Buying Bitcoin?

Ultimate Guide to the MACD Indicator

This Mistake Could Cost You Guides Stock Basics Economics Basics Options Basics Exam Prep Series 7 Exam CFA Level 1 Series 65 Exam. Sophisticated content for financial advisors around investment strategies, industry trends, and advisor education. A Primer On The MACD By Casey Murphy Share.

How to Interpret the MACD on a Trading Chart - dummies

Figure 1 The Indicator Notice how the moving averages diverge away from each other in Figure 1 as the strength of the momentum increases. Figure 2 Another common signal that many traders watch for occurs when the indicator travels in the opposite direction of the asset, known as divergence. Figure 3 Advantages In the previous examples, the various signals generated by this indicator are easily interpreted and can be quickly incorporated into any short-term trading strategy.

Figure 4 Traders should be aware that the whipsaw effect can be severe in both trending and range-bound markets, because relatively small movements can cause the indicator to change directions quickly.

The MACD is a popular moving average based indicator, and it is signaling the downtrend will continue in these stocks. These stocks are exhibiting bearish crossovers in their MACD readings, indicating potential short-term weakness, but also longer-term buying opportunities.

These four stocks recently created a bullish MACD crossover, signaling the potential end of the pullback and the start of the next up-trending wave. One of the most popular trading indicators is the MACD, and right now it's flashing a bullish signal in these four stocks.

Two indicators are usually better than one. Find out how this pairing can enhance your trading. Take a technical analysis look at five stocks that may be heading to the upside in , based on a bullish MACD crossover buy signal.

Take a look inside one of the most popular and widely trusted technical indicators, the moving average convergence divergence, Explore two frequently used momentum indicators in forex trading, the moving average convergence divergence, or MACD, and Learn the importance of the moving average convergence divergence, or MACD, and understand why traders consider it an important Find out why the moving average convergence divergence MACD oscillator is considered one of the simplest, most versatile Learn the best technical indicators to use as part of a trading strategy in conjunction with the moving average convergence In technical analysis, it is common to see a series of numbers following a given technical indicator, usually in brackets.

An expense ratio is determined through an annual A hybrid of debt and equity financing that is typically used to finance the expansion of existing companies. A period of time in which all factors of production and costs are variable.

Free Trader Training Videos - Fast Chart Pattern Stock Screener

In the long run, firms are able to adjust all A legal agreement created by the courts between two parties who did not have a previous obligation to each other. A macroeconomic theory to explain the cause-and-effect relationship between rising wages and rising prices, or inflation.

A statistical technique used to measure and quantify the level of financial risk within a firm or investment portfolio over No thanks, I prefer not making money.

Content Library Articles Terms Videos Guides Slideshows FAQs Calculators Chart Advisor Stock Analysis Stock Simulator FXtrader Exam Prep Quizzer Net Worth Calculator. Work With Investopedia About Us Advertise With Us Write For Us Contact Us Careers. Get Free Newsletters Newsletters. All Rights Reserved Terms Of Use Privacy Policy.